Criminals occasionally prey on SDIRA holders; encouraging them to open up accounts for the goal of generating fraudulent investments. They typically fool investors by telling them that If your investment is accepted by a self-directed IRA custodian, it should be legit, which isn’t true. Once again, You should definitely do thorough due diligence on all investments you decide on.

Constrained Liquidity: A lot of the alternative assets that can be held in an SDIRA, such as real-estate, non-public fairness, or precious metals, may not be very easily liquidated. This can be a concern if you might want to obtain funds rapidly.

SDIRAs in many cases are utilized by fingers-on investors who will be prepared to take on the dangers and responsibilities of choosing and vetting their investments. Self directed IRA accounts can even be perfect for buyers that have specialised expertise in a distinct segment current market that they would want to invest in.

Have the freedom to invest in Just about any kind of asset having a risk profile that matches your investment method; including assets which have the likely for a greater charge of return.

Although there are many Advantages linked to an SDIRA, it’s not devoid of its have negatives. A lot of the popular main reasons why traders don’t decide on SDIRAs incorporate:

Real-estate is among the preferred possibilities among the SDIRA holders. That’s mainly because you'll be able to put money into any kind of real-estate by using a self-directed IRA.

Therefore, they have an inclination not to advertise self-directed IRAs, which supply the flexibleness to speculate within a broader variety of assets.

Choice of Investment Options: Make sure the company enables the categories of alternative investments you’re enthusiastic about, for instance real-estate, precious metals, or private equity.

Feel your Good friend may be starting the subsequent review Facebook or Uber? With an SDIRA, you'll be able to invest in causes that you suspect in; and most likely enjoy higher returns.

Put basically, in the event you’re seeking a tax productive way to build a portfolio visit this web-site that’s far more personalized to your interests and skills, an SDIRA can be The solution.

Higher investment options signifies you'll be able to diversify your portfolio further than stocks, bonds, and mutual resources and hedge your portfolio towards sector fluctuations and volatility.

As an investor, nonetheless, your choices aren't limited to stocks and bonds if you select to self-direct your retirement accounts. That’s why an SDIRA can completely transform your portfolio.

Many buyers are astonished to learn that utilizing retirement funds to speculate in alternative assets has been possible because 1974. Nevertheless, most brokerage firms and banking companies concentrate on supplying publicly traded securities, like stocks and bonds, given that they absence the infrastructure and knowledge to handle privately held assets, for example housing or non-public fairness.

Including funds on to your account. Take into account that contributions are issue to yearly IRA contribution limits established from the IRS.

If you’re seeking a ‘set and overlook’ investing tactic, an Visit Website SDIRA probably isn’t the right decision. Simply because you are in complete Regulate over every single investment built, It is up to you to carry out your individual homework. Try to remember, SDIRA custodians will not be fiduciaries and cannot make recommendations about investments.

IRAs held at banking companies and brokerage firms provide limited investment possibilities for their clientele mainly because they do not have the skills or infrastructure to administer alternative assets.

Of course, property is among our consumers’ most widely used investments, occasionally called a real estate IRA. Purchasers have the option to take a position in everything from rental Qualities, business property, undeveloped land, property finance loan notes and much more.

A self-directed IRA is an very highly effective investment car or truck, but it really’s not for everybody. Given that the saying goes: with good energy comes good responsibility; and with the SDIRA, that couldn’t be additional legitimate. Continue reading to master why an SDIRA might, or won't, be for yourself.

At times, the service fees related to SDIRAs could be better and more challenging than with a regular IRA. It is because with the increased complexity connected with administering the account.

Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Judge Reinhold Then & Now!

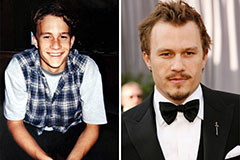

Judge Reinhold Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Nicholle Tom Then & Now!

Nicholle Tom Then & Now!